The Best Guide To Insurance And Investment

Wiki Article

Some Ideas on Insurance Commission You Need To Know

Table of ContentsInsurance Agent Things To Know Before You BuyExamine This Report about Insurance AgentNot known Facts About Insurance AgentThe Facts About Insurance Quotes RevealedNot known Incorrect Statements About Insurance How Insurance Quotes can Save You Time, Stress, and Money.

Insurance uses assurance against the unforeseen. You can locate a plan to cover almost anything, however some are much more vital than others. All of it depends on your needs. As you map out your future, these four types of insurance coverage must be strongly on your radar. 1. Car Insurance coverage Automobile insurance policy is essential if you drive.Some states additionally need you to carry accident security (PIP) and/or uninsured driver protection. These protections pay for medical costs associated with the occurrence for you and also your travelers, no matter who is at mistake. This additionally assists cover hit-and-run accidents and mishaps with motorists that do not have insurance policy.

If you do not purchase your very own, your lending institution can get it for you as well as send you the costs. This might come with a higher cost and with less insurance coverage. Residence insurance policy is a great idea also if you've repaid your home loan. That's because it guards you versus costs for residential or commercial property damage.

Some Ideas on Insurance Expense You Need To Know

In case of a burglary, fire, or disaster, your occupant's plan must cover many of the expenses. It may likewise assist you pay if you have to remain in other places while your residence is being fixed. And also, like house insurance policy, occupants provides responsibility defense. 3. Wellness Insurance policy Health And Wellness insurance coverage is just one of the most crucial types.

The Best Guide To Insurance Asia Awards

You Might Want Impairment Insurance Too "In contrast to what lots of people think, their home or auto is not their biggest property. Rather, it is their ability to make an earnings. Yet, lots of specialists do not insure the opportunity of a special needs," said John Barnes, CFP and also proprietor of My Domesticity Insurance Coverage, in an e-mail to The Balance.Yet you must also consider your requirements. Talk with accredited agents to discover out the most effective means to make these policies help you. Financial planners can offer advice about various other usual kinds of insurance that ought to likewise belong to your monetary plan.

Health and wellness Insurance coverage What does it cover? Health insurance policy is probably the most important kind of insurance coverage.

Insurance Advisor Fundamentals Explained

You most likely don't need it if Every adult need to have health insurance. Kids are usually covered under one of their moms and dads' strategies. 2. Vehicle Insurance coverage What does it cover? There are numerous different types of car insurance that i loved this cover different insurance excess situations, including: Obligation: Obligation insurance policy comes in two forms: bodily injury as well as residential or commercial property damage liability.Injury Protection: This sort of insurance coverage will certainly cover clinical costs connected to vehicle driver as well as passenger injuries. Crash: Accident insurance coverage will cover the price of the damages to your auto if you obtain into a mishap, whether you're at fault or not. Comprehensive: Whereas crash insurance coverage only covers damage to your automobile caused by a crash, detailed insurance covers any car-related damages, whether it's a tree falling on your auto or criminal damage from rowdy area kids.

There are lots of discounts you may be qualified for to reduce your monthly expense, including safe vehicle driver, married vehicle driver, and multi-car discounts. Do you need it? Every state requires you to have auto insurance if you're going to drive a lorry.

Top Guidelines Of Insurance Agent Job Description

You most likely do not require it if If you do not have a vehicle or have a vehicle driver's certificate, you will not require vehicle insurance policy. Home Owners or Tenants Insurance Coverage What does it cover?You might require added insurance coverage to cover natural catastrophes, like flooding, quakes, and wildfires. Occupants check over here insurance covers you against damage or burglary of individual things in an apartment or condo, and also in some instances, your automobile. It also covers obligation expenses if a person was wounded in your apartment or if their items were harmed or stolen from your house.

Do you need it? House owners insurance policy is absolutely vital because a home is often one's most beneficial asset, as well as is frequently required by your mortgage loan provider. Not only is your residence covered, but a lot of your prized possessions and also individual valuables are covered, too. Renters insurance coverage isn't as vital, unless you have a large house that has plenty of valuables.

Insurance Commission for Dummies

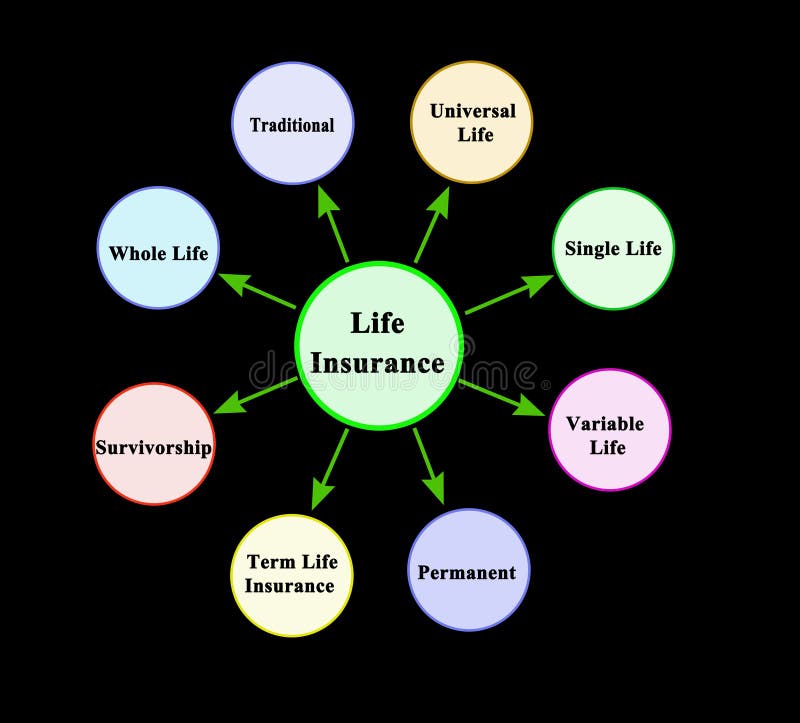

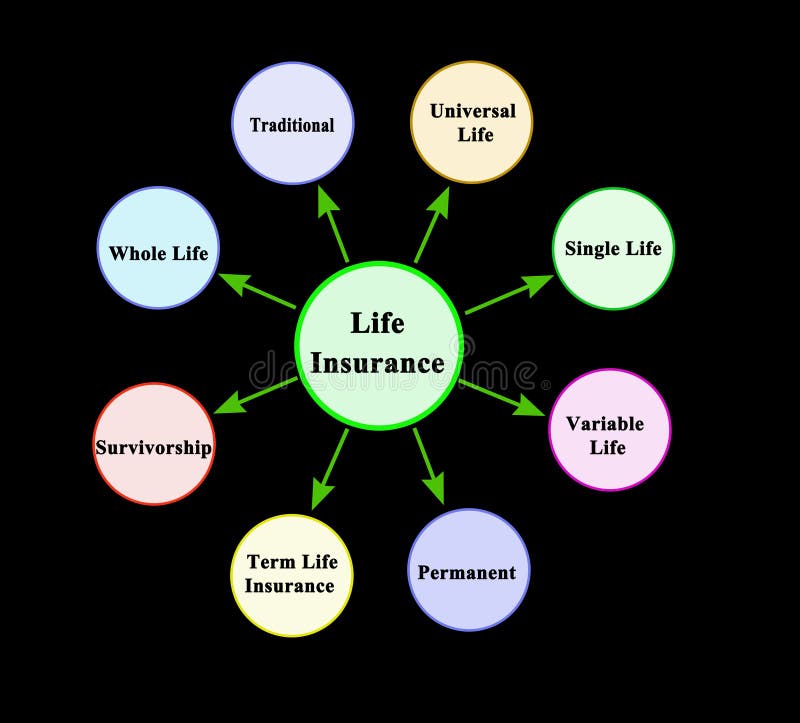

Do you need it? Life insurance policy is the kind of insurance that the majority of people wish to avoid believing concerning. However, it's exceptionally crucial. If you have a family, you additionally have an obligation to make certain they're offered for in the event that you pass previously your time, specifically if you have youngsters or if you have a partner that's not working.

Report this wiki page